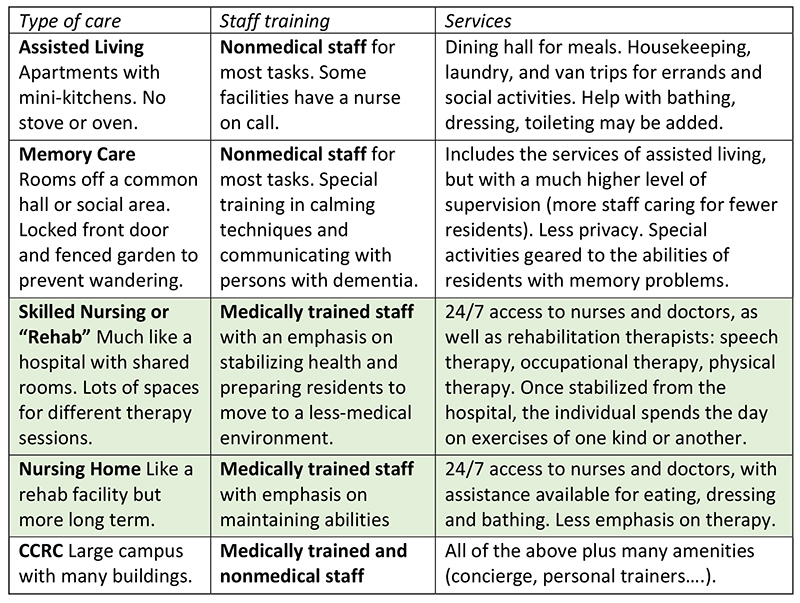

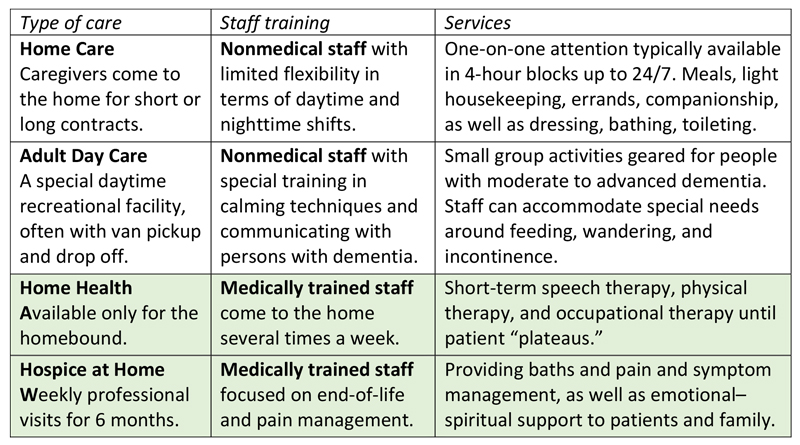

Judy had an emergency hip replacement after a fall. She needs to be discharged tomorrow to a skilled nursing facility. She needs several weeks of intensive physical therapy to be able to walk again. Then she may need to live in assisted living.

The discharge planner has a list of options. Judy and her daughter, who lives an hour away, don’t know how to make a wise choice.

For short-term, urgent needs, you may be at the mercy of which facility has an opening at the time.

It pays to consult a Geriatric Care Manager who knows the reputation and personality of the local institutions. It’s best to have a relationship with the Geriatric Care Manager before you have an urgent need. They can combine extensive knowledge of local resources with a thorough understanding of your medical history, your insurance and financial resources, your personality and preferences, and your social support system. As a result, you are more likely to get a match that will help you maintain good spirits and enjoy a speedy recovery.

Touring these communities can be daunting

A Google search delivers a dizzying array of choices. They all put their best foot forward. But architectural features and social amenities are only superficial measures of quality. A Geriatric Care Manager has had other clients who live in these facilities. As professionals, they have a firm grasp on deeper metrics, such as the tone of the administrative leadership, the training and stability of the staff, the solvency of the company, and the overall personality of the community.

No charge to you

At Advanced Wellness Geriatric Care Management we can help you identify your priorities and make recommendations that meet your needs—at no extra charge. Our time is paid for by a referral fee from the facility you ultimately choose.

Looking for assisted living recommendations? Give us a call at 916-524-5151.

Learn more about our aging life care planning services.

Stay Up To Date With AWGCM